Utility Sales Tax

New York State Utility Sales Tax Refunds : Refunds are based on New York State Sales Tax Law 1115© and 1115(a) 12, which exempts utilities and equipment when used directly in the production of Tangible Personal Property for sale. Tangible Personal Property is defined as: corporeal (physical) personal property of any nature having a material existence and property of any nature having a material existence and perceptibility to the human sense.

The exemption includes production in the Manufacturing, Industrial, Food Processing, and Agricultural Industries. Included in the production of Tangible Personal Property are for examples: meat processing, baked goods, jewelry, furniture, shrubs, wood, chemicals, and prosthetic aids.

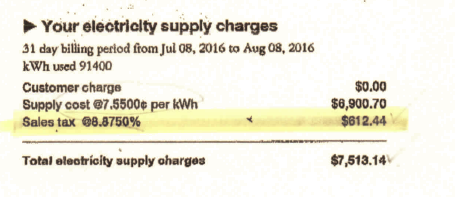

Utility Survey New York State Sales Tax Refund Department requires a Utility Survey as part of a refund claim. The purpose of the Utility Survey is to determine the percentage of the utility used in production(exempt) and non-production (non-exempt).The Utility Survey is used to compute the Kilowatt Hours (using horse power, watts, amperage, voltage), Therms, BTU ’s etc. used in production (exempt) and non-production (non-exempt) for all machinery and equipment used in your business. Exempt is any machinery or equipment used directly in production.

Calculation of Refund Claim: The exempt percentage is computed and then applied to the total Sales Tax paid for the claim period.

BMG has 50 years of NYS Tax Law experience.

BMG will process all the paperwork

NYS Tax Law allows a claim to be retroactive for the last 3 years.

NYS pays interest on the money refunded.

The entire process takes a minimal amount of your time.

BMG will reprocess your claim approximately every 18 months.

BMG provides personable bi-lingual customer service.

BMG provides free Sales Tax Law advice to all of its clients.